(مگاترندهاي جهان را مي شناسيد؟) Decarbonizing Our Toughest Sectors Profitably

1400/08/09

Decarbonizing Our Toughest Sectors Profitably

Cutting carbon emissions from harder-to-abate sectors like heavy transport and industrial heat will create new strategic opportunities for business.

To avert runaway climate change, we must eliminate global carbon emissions by 2050. While much of the focus has been on the main culprits — power plants, buildings, and cars — more than one-third of emissions come from heavy transport such as trucks and planes and the heat-intensive manufacture of materials such as steel and cement. We can’t reach our goal without addressing these sectors, too. But how? They’re widely considered hard to abate — stubbornly resistant to decarbonization, which many believe would be slow, costly, and unprofitable.

But abatement is not only feasible — it will be amply rewarded, if done strategically. In this decade, a rich stew of new technologies, materials, design methods, financial techniques, and business models, along with smart policies and aggressive investments, could revitalize, relocate, or displace some of the world’s most powerful industries. By the 2030s, trucking, aviation, and shipping could be decoupling from climate. Steel, aluminum, cement, and plastics could take new forms, be used more sparingly, and be made in new ways, in unexpected places, under novel business models.

In this article and a companion technical paper,1 I examine business strategies that can help make all this possible and generate trillions of dollars in the process. While the strategies are distinct, they share a common thread: Increasingly competitive and abundant renewable electricity is undercutting and displacing fossil fuels. Outpaced and outcompeted, coal and gas plants are being starved of revenue while their fixed costs per kilowatt-hour rise. Electrified heavy transport and industrial manufacturing heat powered by renewables will likewise undercut, devalue, and strand their fossil-fueled rivals, siphoning off the old technologies’ revenues to fund their own expansion. The growing arguments for making and using renewable electricity will reinforce one another, accelerating the demise of fossil fuels and propelling one of the greatest disruptions in business history.

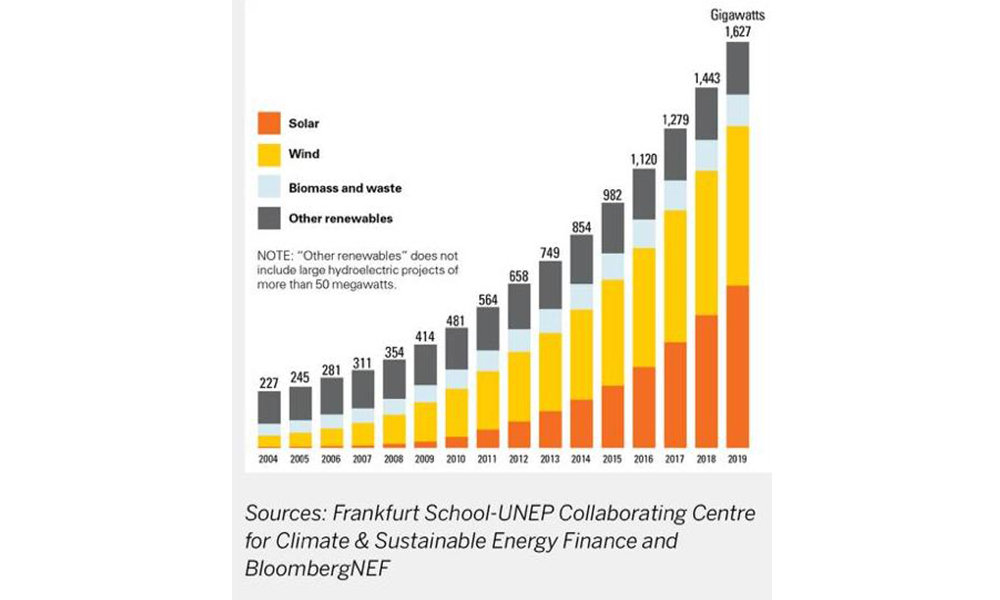

Soaring Renewable Electric Capacity

The electricity-generation capacity of modern renewable sources, chiefly wind and solar, now surpasses that of all hydroelectric dams. According to the International Energy Agency, renewables added a record 278 gigawatts of capacity in 2020 (258 without hydropower), representing 90% of all net capacity additions.

Sources: Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance and BloombergNEF

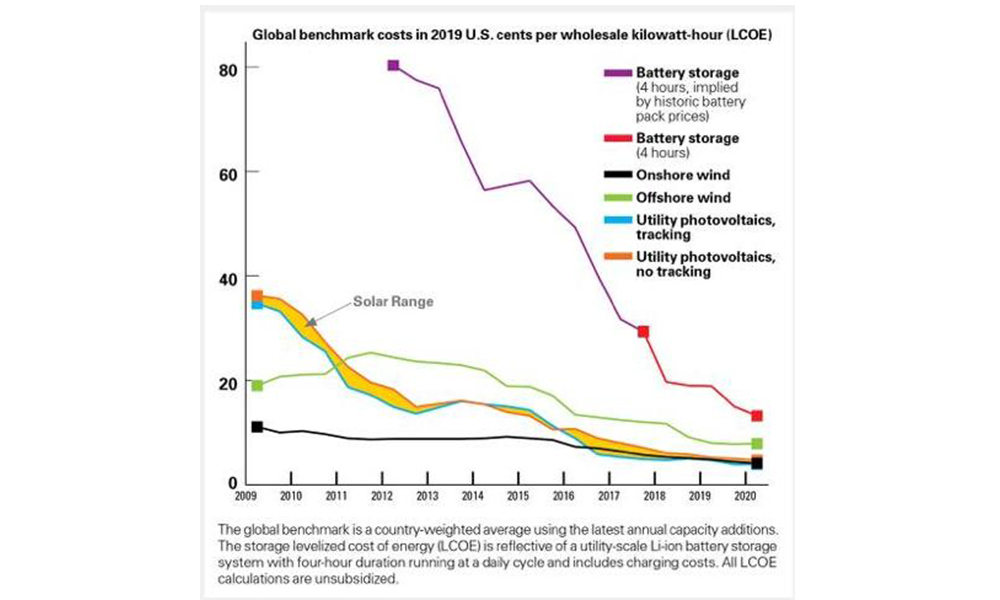

Plummeting Renewable Electricity Costs

Solar power costs have fallen as much as 89% in the past decade, onshore wind power costs have dropped by 63%, and battery storage costs have dropped by 89%. Solar and wind costs are now competitive with fossil fuels’. Further innovation will push these costs even lower in the coming decades.

Source: BloombergNEF

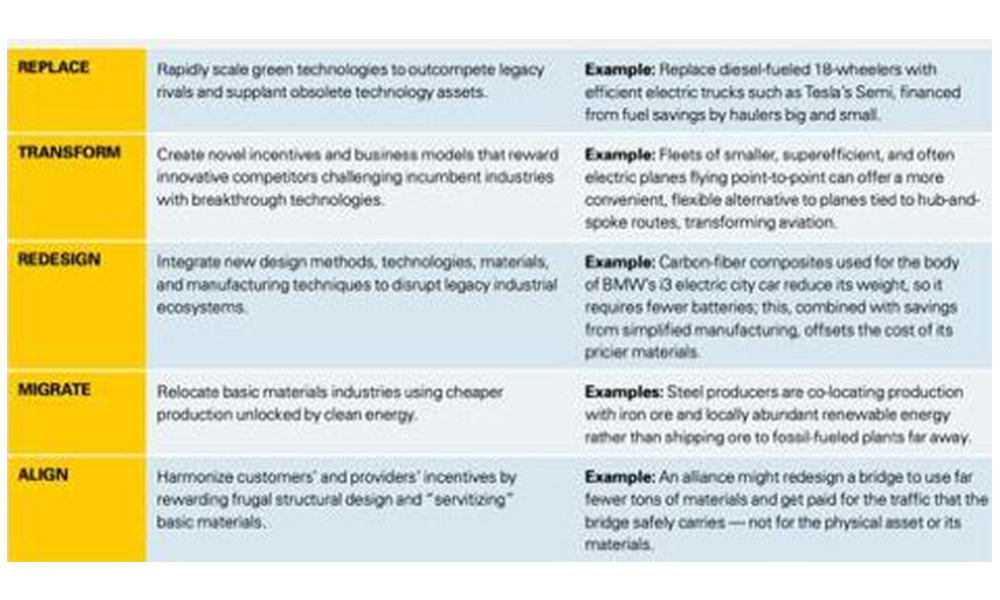

Let’s now explore the five business innovation strategies that will speed this transformation. Each is described as it applies to key sectors where it can bring early wins. But many of these will apply across sectors and can be even more powerful in synergistic combinations.

1. Replace

Rapidly scale green technologies to outcompete legacy rivals and supplant obsolete technology assets.

Heavy road vehicles, chiefly 18-wheel class 8 trucks, average just 6 miles per U.S. gallon and emit nearly 4% of global CO2 — over half of the carbon produced by heavy road transport. This dirty technology is vulnerable to competition, as Elon Musk knew when he unveiled Tesla’s all-electric Semi prototype in 2017. The Semi, designed to displace diesel 18-wheelers, gets over 17 miles per gallon equivalent2 and, if charged with renewable electricity, emits nothing. It can accelerate from 0 to 60 mph in 20 seconds pulling a typical payload (versus diesel trucks’ 1 minute or so), climbs a 5% grade 15 to 20 mph faster than a diesel, and with the latest batteries has a range of about 600 miles — comparable to a diesel truck’s daily range. After a half-hour recharge, it can then go another 400 miles. Tesla expects to deliver the first units in late 2021. While the Semi will initially cost 50% more than a diesel 18-wheeler, Tesla says owners will recoup that premium from saved operating costs in two years and enjoy a million-mile warranty.3 And Tesla has company: In the U.S. alone, at least 14 manufacturers expect to be producing electric heavy trucks by 2023.

While there were just over 2,000 electric trucks of all sizes on U.S. roads in 2019, by some estimates that number could grow to more than 54,000 by 2025. McKinsey forecasts that e-truck demand across China, Europe, and the U.S. could reach 11 million units by 2030. To get a glimpse of electric trucks’ future, consider e-cars’ recent trajectory: Driven by falling battery prices, low life-cycle costs, high performance, and improvements in range, global sales of plug-in autos rose 43% in 2020, reaching 4.2% market share, while total auto sales fell 14%.

Fueled autos are now in their fourth year of shrinking sales. But because battery costs fall 18% with each doubling of cumulative production, electric autos should soon be as cheap to buy as fueled ones. I expect e-truck sales and prices to track e-cars’ trajectory, driven by these same factors. Indeed, Europe’s biggest truck makers are so bullish on e-trucks that they plan to deliver their last fueled truck in 2040, 10 years ahead of schedule.

All of this will require an extensive recharging infrastructure. Until that’s in place, e-trucks will be limited to major transit corridors or to fixed-base (out-and-back) operations — both important markets. Ultimately, e-trucks’ ability to outcompete remaining diesel rigs will depend on a far-flung infrastructure supporting irregular long routes. Although the cost of building it will be high, so is the revenue potential. Truck stops will be motivated to install charging stations to recoup lost diesel revenues, and utility companies will have an incentive to join with (or compete against) truck-stop operators in supporting infrastructure development. Utilities may also chase new revenues by leasing truck batteries separately (with the ripple effect of helping to lower e-truck prices, speeding the trucks’ adoption).

E-truck penetration will also be supported by “smart recharging” and other opportunities to cut costs and generate revenues from charging and storage technologies. Solar and wind power operators can accurately predict their output, revealing when electricity is likely to be abundant and cheap — hence when charging parked trucks’ batteries can cost the least and when selling stored electricity back to the grid can earn the most. Haulers can then add recharging schedules to the variables they optimize. As long-haul drivers sleep, their trucks can earn money, exploiting the trucks’ fast charging and big batteries to sell valuable services back to the grid while preserving the next day’s needed range. Proof of concept: For every e-car battery it manages, the European system integrator The Mobility House earns 1,000 euros annually from exchanging electricity and a dozen other services between the battery and the grid. Each Tesla Semi can exploit a storage capacity that is five to 10 times that of an e-car.

Other innovative incentives and financing strategies include automotive “feebates” — fees on high-emission cars, and rebates on low-emission cars — now provided by many countries.4 Feebates could be effectively extended to trucks. In addition, e-trucks’ fuel savings could be used to pay into leases, enabling small, independent diesel-fueled truckers, who haul most U.S. freight, to replace their inefficient rigs promptly with e-trucks rather than wait years for used hand-me-downs. Because e-trucks are cheaper to own and can last far longer than diesel trucks, we can expect them increasingly to supplant dirtier, more costly, and less durable diesel laggards.

2. Transform

Create novel incentives and business models that reward innovative competitors challenging incumbent industries with breakthrough technologies.

Like trucking, the more complex and risk-averse aviation sector will need clean-energy and efficiency innovations to reduce emissions. Jetliners using 65% to 80% less fuel than today’s fleet were designed over a decade ago by the likes of Boeing, NASA, and MIT but would take a lifetime to emerge if efficiency keeps rising just 2% per year. But novel incentives and business models could rapidly bring established-but-underused innovations to the marketplace — and do so even faster if the latest aviation-efficiency advances are applied.

Consider Otto Aviation’s 2020 Celera 500L prototype, a super-aerodynamic, multifueled long-range air taxi that can expand from carrying six to seating more than 20 passengers. The company didn’t just put a fuel-sipping engine into an existing airframe. It built the 500L from scratch for unprecedented efficiency. The result: The plane has twice the range, eight times better fuel economy, one-sixth the operating cost, and one-fifth the carbon emissions of a comparably fast (but more cramped) business jet. It’s a formidable competitor and an ideal candidate for electrification — the greatest aviation innovation since jets appeared in numbers in the 1950s.

The same battery and efficiency improvements that are driving the explosion in e-cars and e-trucks will allow the first electric short-haul commuter planes from over 100 startups to enter the market in the next few years. E-plane prototypes are already being flight-tested, and United Airlines plans to purchase 200 electric planes worth $1 billion that are expected to enter service in 2024. While short-haul electric flights (those under about 900 miles) will establish the business beachhead, midhaul flights should become possible with continued improvements. Even long-haul flights might become possible, particularly with the advances in electric flight powered by hydrogen fuel cells that some companies are now pursuing.

Currently, fuel is a dominant and volatile aviation cost. Superefficient-and-electric planes will eliminate this cost and uncertainty. With their far lower operating costs, fleets of smaller and more flexible e-planes could offer frequent, convenient, clean, quiet, and economical point-to-point flights serving 5,000 U.S. airports and tens of thousands of international ones. The vertical takeoff and landing capability some startups are developing could enable planes to bypass airports entirely. Thus, we can expect e-planes to challenge traditional airline and commuter-jet business models that are built around less flexible, affordable, and convenient hub-and-spoke route architectures and are dependent on liquid fuels. Electric air taxis could push traditional short-haul planes out of service, stranding the incumbents’ assets and — if these legacy carriers don’t get on board — hastening their decline.

While investors and some buyers are already putting money into e-plane startups, cash-short airplane buyers and builders are understandably cautious. How do we encourage further radical, seemingly risky efficiency improvements? One approach is to de-risk makers’ development investments through “golden carrot” purchase commitments. Long used to elicit efficiency gains for smaller products such as refrigerators, these may work with planes, too (or trucks, trains, or ships, for that matter). In short, big customers collectively commit to buy X units a year for Y years at price Z from whatever vendor first achieves, say, a fourfold efficiency gain while meeting all standard requirements. (The runner-up gets a smaller slice.) Such a big prize isn’t just a bigger bulk buy; it provides an incentive for both the development and purchase of innovative vehicles, rewards gutsy innovation over timid incrementalism, and has the potential to transform makers’ and buyers’ cultures by raising their innovation tempo, performance ex

pectations, and appetite for strategic risk-taking.

Five Business Strategies for a Net-Zero 2050

The growing arguments to make and use renewable electricity will reinforce one another. Here are five strategies for businesses to drive and benefit from the transformation.

3. REDESIGN

Integrate new technologies, materials, and manufacturing methods to disrupt legacy industrial ecosystems.

Energy-efficiency efforts traditionally seek to optimize isolated parts of larger technical devices or systems, like a diesel or jet engine. But optimizing the efficiency of vehicles, buildings, and factories as whole systems can double or triple energy savings at lower cost.5 Such integrative design, which combines new technologies, materials, manufacturing methods, and business models, will help disrupt vast, slow, overly mature industrial ecosystems.

Let’s focus on a key element of many new integrative vehicle designs: advanced materials. Carbon fiber is far stronger and lighter than steel but also costs more per pound. You might conclude, therefore, that replacing a car’s or truck’s ton or more of steel with carbon fiber would increase its cost. But with integrative design, it needn’t. The body of BMW’s 2013-22 i3 electric city car is made entirely from carbon-fiber composites. But because this saves weight, the i3 needs fewer batteries, offsetting the carbon-fiber cost. Further, its radically simplified manufacturing process uses two-thirds less capital and space and half the water, energy, and time, and it doesn’t require a conventional body or paint shop (where the two hardest and costliest parts of traditional automaking are done). All of this makes the i3’s valuable weight reduction approximately free — so the quadrupled-efficiency car was profitable from the first unit made.6

Likewise, a radically simplified 95% carbon-fiber fighter plane designed by Lockheed Martin’s Skunk Works in the 1990s was one-third lighter and two-thirds cheaper than its 71% metal predecessor. Its lead engineer went on to design a carbon-fiber sport utility vehicle that was half the previous weight and four to six times more efficient. Now China plans to cut its flagship cars’ steel use by 80% in this decade by substituting light metals and carbon fiber. Ultimately the average U.S. car could shed over a ton of iron and steel, replaced by lighter but higher-value polymers. Carbon-fiber ships and trains, too, are starting to move beyond prototypes and specialty applications and into the mainstream. These examples foretell other lighter, more fuel-efficient, more easily electrifiable and lower-cost heavy-duty vehicles displacing steel ones. And since carbon fiber doesn’t rust and scarcely dents or fatigues, combining it with ultrareliable electronics and electric motors could also make light or heavy vehicles last far longer, favoring leasing over sales and the manufacture of fewer vehicles with greater value.

Other advances in materials, combined with integrative design, hold particular promise for planes, where every pound cut can save $1,000 worth of fuel — and related emissions — over the plane’s lifetime. NASA and several universities, for example, have demonstrated a plastic lattice structure for building aircraft. It’s as strong and tough as the flexible polymer membrane surrounding it but 98% lighter than a metal structure. Like a bird’s wing, its shape can morph in real time to cut drag, boost lift, and save energy. If the air is evacuated from the lattice, such crush-resistant structures could form a “vacuum balloon” whose buoyancy could help offset the weight of electric airplanes’ batteries — a promising if, as of yet, only theoretical bit of engineering.

Ultimately, ultralight, superefficient electric cars and even planes could become partly or wholly solar powered. Later this year, two startups aim to begin selling electric Hypercars — vehicles that are so efficient, they need little or no plug-in recharging. Aptera’s composite NeverCharge is a two-seat three-wheeler with less air drag than the side mirrors of the most popular pickup truck. Parked outdoors, its topside solar cells can power it for a conservative estimate of up to 11,000 miles per year. Its daily solar-only range is only around 40 miles, but plugging it in recharges the battery for a range of up to 1,000 miles. Dutch startup Lightyear’s five-seat sedan similarly blends solar power with efficient operation, gaining 8 miles of range per hour in the sun. Both examples are proofs of concept that superefficient solar-powered or -assisted vehicles, including trucks and even ships and planes, could join our future zero-carbon transportation mix — and complement the faster expansion of a smaller recharging infrastructure.

To ride this wave of change, incumbent automakers must invest in belated asset, technical, and cultural transformation while living on revenues from the obsolete fueled products that their new offerings are meant to squash. Few are well positioned for the upheaval to come: A recent KPMG report on electric-vehicle trends concluded that “old empires may fall” in the transition and “massive structural change” of the industry could doom some major companies. Preparing for the inevitable, several manufacturers have announced plans to build their last fueled vehicles within a decade or two, among them Volvo by 2030 and General Motors by 2035. Next, the integrative design, electrification, lightening, and other efficiency advances coming swiftly to cars will surely reconfigure all of heavy transport, supplanting fueled vehicles. Business model innovations supported by superefficient integrative design, such as Otto Aviation’s ambition to leapfrog incumbents with its fuel-efficient point-to-point air taxi, show the way for upstart competitors.

4. Migrate

Relocate basic materials industries using cheaper production unlocked by clean energy.

Let’s shift gears now (a phrase that will become an anachronism as electrification eliminates transmissions) to innovations that can decarbonize industrial heat — the thermal energy needed to make steel, cement, and other basic materials. Coal-fired steel-making blast furnaces, coal- or gas-fired cement kilns, ethylene plants, and the like emit one-fourth of global carbon dioxide, including 7% to 8% each for cement and steel, 3% for chemicals (mainly fertilizers and plastics), and 1% for aluminum.

Those emissions from burning fossil fuels could be eliminated by instead generating heat directly from renewable electricity or delivering it via hydrogen, infrared radiation, microwaves, or superhot gaseous plasmas. (Nine percent of the world’s heat needs, from low-temperature space heating to high-temperature industrial heating, already are met directly by solar and geothermal sources or burning biomass.) Some existing manufacturing plants will switch to renewable heat. Others will be replaced by purpose-built plants in regions with cheap renewable electricity. That creative destruction could strand trillions of dollars of fossil-fuel-based heavy-industry investments and produce trillions of dollars’ worth of new ones.

Making metals was always about location — good ore near cheap energy. From 12th century Song dynasty China and Industrial Revolution England and Germany to 20th century America’s Upper Midwest, the proximity of coal to iron ore spawned massive iron and steel industries. Today, ore is often shipped from afar to hungry markets; Australia and Brazil, for example, ship iron ore to Chinese coal-fired blast furnaces, which make half the world’s steel. Such dirty process heat will give way to clean heat generated by renewables — elsewhere in China or imported — or clean-heat processes will shift abroad altogether.

That’s why Sweden’s steel industry plans to build a renewably powered mill in the Arctic iron-mining town of Gällivare. Foreseeing demand for “green steel,” this year Swedish joint venture Hybrit’s pilot plant in Luleå began using hydrogen made from hydroelectricity to turn local ore into CO2-free steel that Volvo plans to start putting into truck parts next year. Rival H2GreenSteel’s industrial-scale production is due to begin in 2024, aiming for 5 million tons of steel per year before 2030.

Australia’s Fortescue Metals is likewise planning to build a green-steel pilot plant this year that taps the country’s abundant sun and wind to produce hydrogen. It then plans to build a commercial plant in Western Australia’s Pilbara region, co-locating production with iron ore and locally abundant renewable energy rather than shipping ore to dirty steel mills far away. Such green steel should beat many fossil-fueled mills’ prices and ultimately strand their assets. Combining cheap local renewables with growing demand (and perhaps a price premium) for green steel could bring its production not just to places rich in iron ore, like Australia, India, and South Africa, but also to areas with modest ore deposits, like North Africa and Chile, or none, like the Middle East. Along the same lines, the United Arab Emirates’ solar-powered smelter turns Guinean bauxite into green aluminum for German cars.

Renewable energy itself can also be exported: Saudi Arabia is building a $5 billion sun- and wind-powered plant to produce “green hydrogen” and, starting in 2025, ship it in the form of liquid ammonia (NH3) to join the projected $700 billion annual hydrogen market. BloombergNEF just announced that with solar electricity’s 2050 price now predicted to be 40% below 2019’s forecasts, green hydrogen will beat natural-gas-based hydrogen in this decade and become stunningly cheap — ideal for use in heavy industries like steel.7

Fossil-fueled cement-making is another rich target for renewable industrial heat. Currently, over half the world’s cement is made in China using coal for heat. Solar-superheated air could soon become competitive with coal or gas for this purpose (and would also have to compete with green hydrogen). To test the concept, global cement giant Cemex and ETH Zurich spinoff Synhelion are building a solar-heated pilot cement kiln. And U.S. startup 247Solar’s prototype concentrators (competing with Heliogen’s) can heat air to 1,800 degrees Fahrenheit, at a gas-competitive cost, and provide overnight storage so it can deliver process heat whether the sun is shining or not. Processes that need milder heat, like most chemical plants, can already use solar steam or electric heat pumps at lower cost than burning natural gas.

If run as planned for their lifetimes, just the world’s most carbon-intensive $22 trillion worth of 2018 electricity, transport, and industrial assets would break the world’s total carbon budget. And just a fourth of those assets will emit three-fourths of that CO2 if not retired sooner. But if, hypothetically, the world’s entire coal power plant fleet were replaced today by renewables plus storage, that swap could be cost-neutral within two years and by 2025 could return over $100 billion annually, even with side benefits to climate and health valued at zero.8 Energy, transport, and industry are all awash in imminently stranded assets and in opportunities to realign asset portfolios and remobilize trapped capital. As trillions of dollars rush in to fund both “out with the dirty” and “in with the clean” initiatives, Warren Buffett’s sage advice applies: When horseless carriages enter the market, don’t overanalyze which newcomer will win; short the horses.

5. Align

Harmonize customers’ and providers’ incentives by rewarding frugal infrastructure design and “servitizing” basic materials.

As we’ve seen, traditional processes for manufacturing cement, steel, and other energy-intensive materials are expensive and dirty and generate billions of tons of CO2 annually. Manufacturers and their customers have a common interest in reducing these costs. For both, squeezing waste out of the system represents one of the biggest business opportunities on the planet — and over 99% of the materials the world mines or grows are now wasted.

The giant industries that make and use basic materials are developing low- or no-carbon substitutes, and manufacturers are switching to more efficiently used, milder, or cleaner process heat. All of that is part of the solution. So is providing incentives for materials reuse, remanufacturing, and recycling: A more circular economy could save up to 37% of steel, 34% of cement, 40% of aluminum, and 56% of plastics, cutting materials-related CO2 by 40%.9 And making buildings durable in the first place and then maintaining them can help; while cement-intensive Chinese buildings erected in recent decades have average life spans of just 30 years, well-tended concrete buildings can last for centuries. Rome’s Pantheon dome, the world’s largest unreinforced concrete structure, has stood for nearly 2,000 years.

These approaches to improving materials productivity are important but overlook the vast opportunity presented by reducing the amounts of cement, steel, and other structural materials that buildings need. Authoritative analyses suggest that 11% of cement and 9% of steel could be profitably and practically saved by simply using fewer tons more efficiently.10 But with new designs that make frugal use of materials, and the transformation of materials into services, the potential savings seem far larger.

These design methods and business models will lead to a reduction in the extraction, processing, and transport of materials, allowing less capital to deliver more profit with less risk. That financial white space, I believe, holds the promise of redefining or displacing much of current extraction and materials-manufacturing industry. Many businesses based on selling tons rather than outcomes must either leap that chasm or vanish into it.

Frugal Design

Certainly, fixing innumerable little wastages across the complex value chain of construction can save gigatons of materials each year. However, novel designs that confer the same structural integrity with less material appear to be able to save at least as many tons and could halve builders’ bills for steel and concrete, profitably and without compromise.

For example, airy single-tower suspension bridges and soaring cable-suspended stadium roofs can weigh 80% to 90% less than traditional structures. Pouring concrete not into flat box-like forms but into curving fabric forms, thinner where less strength or stiffness is needed and bulging where more is needed, can save at least half the concrete and steel needed to make traditional beams. The massive design of conventional concrete bridges mostly exists to support their own weight, but 3D printing can make bridges so strong and slender, supported by myriad delicate-looking branches, that their design is mostly directed toward carrying the payload.

Floor slabs account for about half the total weight of a typical mid- or high-rise building, and hefty concrete and steel beams, columns, and foundations to support all that weight make up much of the rest. But folding a thin, carbon-fiber reinforced floor slab into a structure like corrugated cardboard’s makes it as stiff and strong as a solid slab six times thicker and four times heavier. Another strength-through-geometry solution, saving up to 70% of materials, is a thin and shallow shell rounded as a curving vault and extended to a flat top by thin stiffening ribs — perhaps making modern civil works as materials-efficient as a 13th century Gothic cathedral.

Servitizing

Such a focus on increasing materials productivity — using less to do more — enables a new business model for cement and steel companies: not selling by the ton, but rather leasing the structural services that these materials provide. When providing a ton of cement becomes a cost in a service model rather than a source of sales revenue, the fewer tons needed to deliver the same or better service, the more money the provider and customer both save. Thus, frugal design combined with a service model can be richly rewarded as both provider and customer profit by doing more and better with less for longer. And providers benefit from a steady stream of lease payments, which replace episodic payments that fluctuate with volatile commodity prices. You want the use, the outcome — not the stuff. You can enjoy a fine meal without owning the restaurant.

Selling services derived from products rather than the products themselves — what lean gurus Jim Womack and Dan Jones dubbed the “solutions economy” around 2005 — is now called servitizing or servitization by the World Economic Forum.11 The sale of jet-engine thrust as a service, known as Power-by-the-Hour, was pioneered by Bristol Siddley in 1962 and refined by Rolls-Royce in 2002; Xerox started selling copying by the page, not the machine; and Dow and Safety-Kleen switched from selling solvents to delivering “dissolving services.” This model has spread across sectors from indoor climate control, lighting, elevators, and roofing to digital media, pallets, truck tires, and personal mobility. Why not structures, too? For example, when smart design can use a ton of concrete and steel at least twice as productively as normal practice, a cement or steel company — or, ideally, both together — could form an alliance to offer “bridge services.” Such an alliance could design an advanced bridge using a fraction of the usual materials, pay its structural engineers for elegant frugality, arrange for careful construction and maintenance, and get paid for the traffic that the bridge safely carries — not for the physical asset or its materials. When I proposed this solutions-economy model to the head of a large cement maker years ago, he replied, “Good idea. I have 200 people working on that.”

Copper likewise could be servitized. Where is the world’s richest copper deposit — under Papua New Guinea? Chile? Or perhaps Manhattan, buried in wires and cables? Had copper miners not sold tons of metal to makers of wire and cable, which was then sold to Con Edison and AT&T (which then buried it), a conductance-services provider — let’s call it “ConductCo” — could instead have installed its durable copper retrievably. That way, as it researched and developed alternatives like efficient electricity use, distributed generation, and broadband wireless, ConductCo could readily recover its copper and re-lease its services to new clients. As steel, copper, gold, lithium, and other metals become servitized, mining companies may evolve into metal-services financiers and brokers — and remote ore deposits can keep on quietly holding up the ground.

Despite the vast profit potential in servitizing construction materials industries, there are daunting obstacles, chief among them that these are highly risk-averse, innovation-resistant sectors. In addition, most clients neither request nor reward materials efficiency and in fact tolerate or even extol huge overdesign margins.12 Progress will depend on the work of outstanding, trusted civil and structural engineers who think differently and prefer brave rigor to timid groupthink. Structural service providers that partner early with these top designers, reward their performance, help grow and apply their talent, and assemble an alliance of suppliers, designers, and builders delivering better, cheaper buildings could beat laggards stuck with inferior designers and commodity businesses. Reforming client and designer cultures will be slow and hard, but the sharpness of both these players’ competitive spears should help pierce tough layers of encrusted habit.

These five strategic innovations all depend on new business models and financial products to speed the graceful retirement of dirty industrial assets (blast furnaces, diesel fleets, coal-fired power stations, and more), finance their clean replacements, and speed capital flight from obsolete to advantageous assets and industries. I’ve touched on some of them here — servitization of materials, clean electricity arbitrage, feebates, golden-carrot purchase agreements, and early asset retirement among them. These, combined with focused and comprehensive efforts to improve efficiency — via conventional savings, integrative design savings, materials savings from frugal design, and others — will squeeze fossil fuels out of power generation, buildings, industry, and vehicles. This would more efficiently allocate capital, make more money, do more good, and be more fun (for insurgents, if not incumbents).

Getting this done requires investment in energy and materials efficiency whenever it’s cheaper than inefficiency; rewarding utilities for cutting energy bills rather than selling energy; rewarding designers for what they save, not what they spend; prioritizing barrier busting in policy, not only proper energy pricing; and refocusing public policy and private-sector strategies to enable the new, not protect the old. Who won’t like that? Corporate socialists masquerading as free marketeers. Who will? Serious conservatives, entrepreneurs, smart investors, and everyone who understands that roasting the planet is bad for business and for all beings.

Related Articles

Companies Must Find the Courage to Back Up Statements on Climate Action | Andrew Winston and Paul Polman

Sponsor’s Content | 3 Priorities for Accelerating Your Operating Model Transformation

What Everyone Gets Wrong About the Never-Ending COVID-19 Supply Chain Crisis

Rethinking Assumptions About How Employees Work

Don’t assume that these changes will wait until after you retire. Visionaries like futurist Tony Seba argue that the world is “on the cusp of the fastest, deepest, most profound disruption of the energy sector in over a century” — a phase change leading to a new system with very different rules and outcomes. BloombergNEF’s deeply empirical analyses broadly concur.13

Even in the short run, capital flight from fossil fuels to renewables and efficiency is accelerating. Last year, despite the pandemic, the growth of renewables accelerated 45% — briskly enough to meet all future demand growth, condemning fossil fuels to permanent decline from their likely 2019 peak.14 This triggered a self-reinforcing capital stampede from fossil fuels to their fast-growing replacements, sped by some targeted pandemic recovery investments, including 1 trillion euros in Europe. My five strategies could further pick up the pace. Turning fossil fuels’ gentle slide into a mighty avalanche is a worthy goal for a future that makes sense, makes money, proceeds from applied hope15, and creates a richer, fairer, cooler, safer world worth being hopeful about.